Staking crypto has become a core strategy for traders looking to earn yield without relying on market swings alone.

As more platforms introduce different reward systems, the real advantage now comes from understanding how each model structures returns, limits supply, and manages participation.

Some options move slowly with predictable payouts, while others use mechanics that shift the reward window as activity increases.

That difference is why many traders are paying closer attention to Noomez as the presale continues to progress.

The 5 Staking Platforms Traders Are Watching Closely in 2025

To learn what is staking crypto comes down to one idea: rewards depend on how each system handles supply, timelines, and user participation.

Among the options gaining attention this year, five platforms stand out for their staking frameworks, though only one uses a time-sensitive model that changes as the presale moves forward.

1. Noomez ($NNZ)

Noomez is the only platform in this list where staking rewards are tied directly to visible progression.

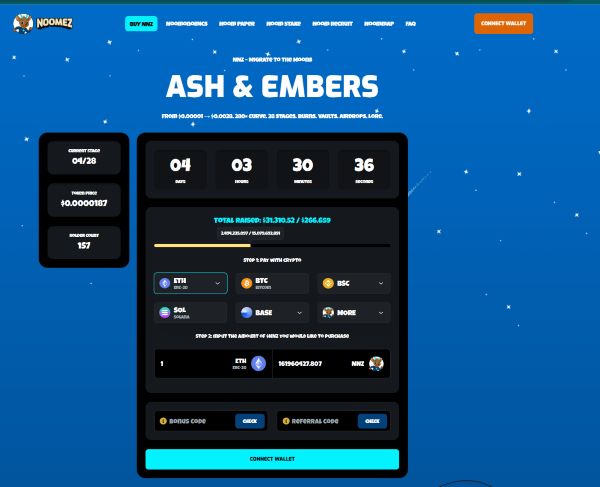

With Stage 4 now priced at $0.0000187, 162 holders, $33,134.64 raised, and the allocation moving toward 20% completion with just over four days left on the timer, every update inside the dashboard shifts the reward window.

For anyone asking what is crypto staking in a modern context, Noomez shows how timed mechanics can influence yield before launch even begins.

The Noom Engine adds another layer by distributing partner-token drops automatically, giving stakers direct exposure to outside projects without extra steps.

Stage X Million Airdrops and the upcoming Vault Events at Stages 14 and 28 push rewards higher as the presale advances, which is why early positioning has become a strategic advantage in this model.

- Active presale staking

- Long-term staking is available after launch with a 66% APY

- Automatic partner-token drops via the Noom Engine

- Stage X Million Airdrops are tied to progression

- Vault events with escalating rewards

- Unsold tokens burn, increasing supply pressure

- 6-12 month vesting arcs reinforcing long-term holder pressure

2. Lido (LDO)

Lido remains one of the larger liquid staking options, but its reward system moves at a steady pace without the time-sensitive mechanics that shape early participation elsewhere.

Returns adjust slowly based on network activity, and the platform’s structure focuses more on maintaining liquidity than creating new incentives.

- Liquid staking for major assets

- Rewards fluctuate with network performance

- No scheduled catalysts or timed reward windows

- Long-term yield profile without urgency

- Dependent on broader market conditions rather than internal triggers

3. Polkadot Staking (DOT)

Polkadot’s staking system is built around predictable network participation, offering steady returns without any structural events that shift rewards over time.

The model functions reliably, but it doesn’t introduce catalysts or timed mechanics that influence when users choose to stake, making it a slower-moving option in comparison.

- Delegated staking through validators

- Consistent, market-dependent rewards

- No stage-based progression or supply pressure

- Yield is shaped by overall network participation

- Long-term staking without time-sensitive incentives

4. Cosmos Staking (ATOM)

Cosmos offers a straightforward staking system built around validator participation, with rewards that shift slowly as the ecosystem evolves.

While the model is reliable for long-term holders, it lacks any built-in triggers or timed events that influence the reward window, so activity tends to follow broader adoption rather than internal structure.

- Delegated staking through validators

- Rewards adjust gradually with ecosystem usage

- No scheduled catalysts or supply-driven mechanics

- Long-term, adoption-based yield model

- Stable staking structure without urgency

5. Cardano Staking (ADA)

Cardano’s staking system is designed for long-term consistency, offering predictable returns through stake pools without requiring active management.

While dependable, its reward model changes only with broader network participation and does not include any timed incentives or internal events that affect the staking window, resulting in a slower and more gradual path to yield.

- Stake-pool-based delegation

- Stable, predictable reward distribution

- No time-limited mechanics or stage progression

- Yield is shaped by overall network activity

- Passive, slow-moving staking structure

Why Noomez Token Stands Out Among Staking Platforms in 2025

When traders look at what is staking in crypto from a reward-timing perspective, Noomez is the only platform where the window actually tightens as activity increases.

Each stage raises the price, burns remove unsold supply, and the countdown pushes staking opportunities forward.

With presale staking already active, Vault Events ahead, and its Five Arc model, Noomez turns progression into pressure, something the other platforms simply don’t offer.

Pro Tip: Stake earlier within each Noomez stage. The APY advantage increases as supply tightens and the next price step approaches, giving early stakers a stronger position within a rising structure.

For More Information:

Website: Visit the Official Noomez Website

Telegram: Join the Noomez Telegram Channel

Twitter: Follow Noomez ON X (Formerly Twitter)

Disclaimer: This is a sponsored press release. CryptosNewss does not endorse or guarantee the content. Readers should verify facts and conduct independent research before making financial decisions.